![]() QRGI (Government Relief Index) o índice de alivio gubernamental , NASDQ anuncio el nuevo índice .

QRGI (Government Relief Index) o índice de alivio gubernamental , NASDQ anuncio el nuevo índice .

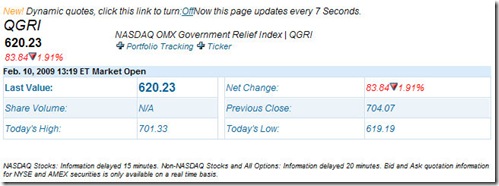

NEW YORK, Jan. 8, 2009 (GLOBE NEWSWIRE) — The NASDAQ OMX Group, Inc. (Nasdaq:NDAQ) today introduced the NASDAQ OMX Government Relief Index(sm) (Nasdaq:QGRI).

Este índice refleja la performance o rendimientos que tienen las acciones de las empresas en las que el gobierno de EEUU a decidido invertir fondos públicos .De esta forma los contribuyentes y otros inversores pueden ver el desarrollo de estas inversiones .

El NASDAQ OMX Government Relief Index esta compuesto por un grupo de múltiples industrias que reciben una inversión directa del gobierno de mas de 1 billón de dólares.

El índice es calculado por medio de la combinación de varios valores de acciones y medido en dólares . Este comenzó el 5 de enero del 2009 con una valuación de 1000 .

En el siguiente link se puede ver su valor actual QGRI .

Fuente :

New Benchmark Tracks Companies That are Participating in the U.S. Government’s Financial Relief Plan

NEW YORK, Jan. 8, 2009 (GLOBE NEWSWIRE) — The NASDAQ OMX Group, Inc. (Nasdaq:NDAQ) today introduced the NASDAQ OMX Government Relief Index(sm) (Nasdaq:QGRI). The index enables investors to track the performance of U.S.-listed securities that are participating in U.S. government sponsored relief programs such as the Troubled Asset Relief Program (TARP) or other direct government investments. The NASDAQ OMX Government Relief Index is the latest index launched by NASDAQ OMX Index Group and underscores its commitment to designing and calculating relevant world-class indexes.

"This Index allows taxpayers and other investors to measure the performance of U.S. companies that are participating in the government’s financial relief plan," said NASDAQ OMX Executive Vice President John Jacobs. "We believe the NASDAQ OMX Government Relief Index will be useful in helping investors evaluate the government’s investments and the impact of the relief plan on the economy during this period of historical significance."

The NASDAQ OMX Government Relief Index consists of companies across multiple industry groups that have received a direct investment from the U.S. Government greater than $1 billion. The Index is the first of the Government Relief Index Series that NASDAQ OMX will be launching in the coming weeks.

The Index is calculated in real-time across the combined exchanges and is disseminated in dollars. The index began calculation with a value of 1000.00 on January 5, 2009.

NASDAQ OMX is a global leader in creating and licensing strategy indexes and is home to the most widely watched indexes in the world.

As a premier, full-service provider, NASDAQ OMX is dedicated to designing powerful indexes that are in sync with a continually changing market environment. Utilizing the expanded coverage of our global company, NASDAQ OMX has nearly 2,000 diverse equity, commodity and fixed-income indexes in the U.S., Europe, and throughout the world.

In addition, our calculation, licensing and marketing support provide the tools to measure and replicate global markets. The NASDAQ OMX Index Group range of services covers the entire business process from index design to calculation and dissemination. For more information about NASDAQ OMX indexes, visit https://indexes.nasdaqomx.com/.

About the NASDAQ OMX Group

The NASDAQ OMX Group, Inc. is the world’s largest exchange company. It delivers trading, exchange technology and public company services across six continents, with over 3,900 listed companies. NASDAQ OMX Group offers multiple capital raising solutions to companies around the globe, including its U.S. listings market; NASDAQ OMX Nordic, NASDAQ OMX Baltic, including First North; and the U.S. 144A sector. The company offers trading across multiple asset classes including equities, derivatives, debt, commodities, structured products and ETFs. NASDAQ OMX Group technology supports the operations of over 70 exchanges, clearing organizations and central securities depositories in more than 50 countries. NASDAQ OMX Nordic and NASDAQ OMX Baltic are not legal entities but describe the common offering from NASDAQ OMX Group exchanges in Helsinki, Copenhagen, Stockholm, Iceland, Tallinn, Riga, and Vilnius. For more information about NASDAQ OMX, visit http://www.nasdaqomx.com.